infrastructure investment and jobs act tax provisions

2 section 147 of the Surface Transportation. B Exceptions--The limitations under subsection a shall not apply to obligations under or for-- 1 section 125 of title 23 United States Code.

The Infrastructure Investment And Jobs Act S Attack On Crypto Questioning The Rationale For The Cryptocurrency Provisions Cato Institute

Infrastructure Investment and Jobs Act which was signed into law on November 15 2022.

. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known. Tax-related provisions in the Infrastructure Investment and Jobs Act Early termination of the Employee Retention Credit. A 740 billion climate and health care bill known as the Inflation.

President signs bipartisan infrastructure bill tax provisions are enacted. The vote was 228 to 206. House of Representatives tonight passed HR.

Roads bridges and major projects. Infrastructure Bills Employer Provisions. The American Rescue Plan Act ARPA had extended the credit to eligible employers for the third and fourth quarters of 2021.

Allows private activity bonds for qualified broadband projects and carbon dioxide capture facilities 4. Among other provisions this bill provides new funding for infrastructure projects including for. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy.

3684 the Infrastructure Investment and Jobs Act. Part of that initial plan became law through the Infrastructure Investment and Jobs Act. The legislation includes tax-related.

While the bulk of the law is directed toward massive investments in infrastructure projects across the country a handful. Extends and modifies certain Superfund excise taxes 3. Federal tax benefits such as tax.

Expands certain I See more. Under the new law the ERC which for 2021 is worth. The IIJA also includes several tax extensions.

The Infrastructure Investment and Jobs Acts key provisions affecting employers are highlighted below. President Biden signed the bill into law on November 15. On November 15 2021 President Biden signed into law the Infrastructure Investment and Jobs Act Public Law 117-58 which is also known as the Bipartisan.

Almost three months after it passed the US. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked inside it. ENds the Employee Retention.

Infrastructure Investment and Jobs Act. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked inside it.

While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax provisions are tucked inside it. We also discuss provisions in the recently enacted. Extends pension funding relief 5.

Extends several excise taxes used to fund highway spending 2. Download pdf 27 MB President Biden today signed into law HR. During 2021 the remainder.

Heres what you need. The IIJA terminates the Employee Retention.

Joint Statement On U S Senate S Passage Of The Infrastructure Investment And Jobs Act Advocates For Highway And Auto Safety

The Infrastructure Bill Tax Provisions Hm M

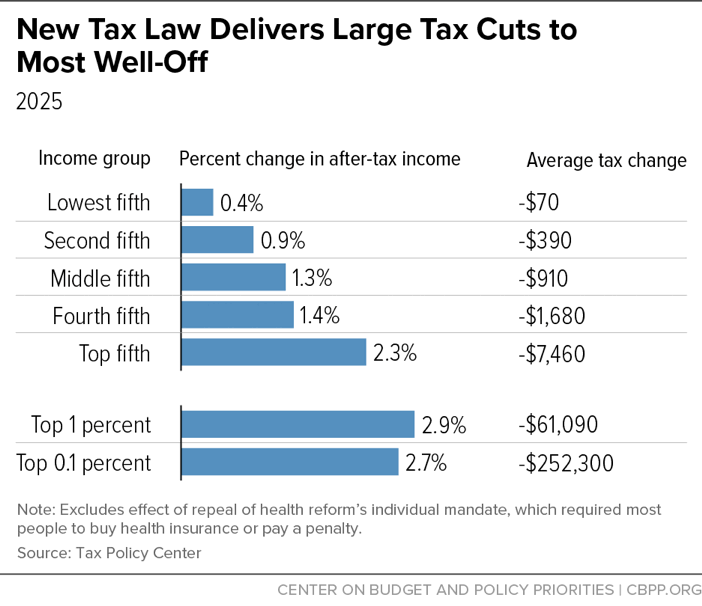

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

Infrastructure Investment And Jobs Act Includes Several Tax Provisions With Little Fanfare

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Hood Strong

Tax Exempt Bond Provisions Included In The Infrastructure Investment And Jobs Act Barclay Damon

2021 11 08 Tax Provisions In The Infrastructure Investment And Jobs Act Youtube

/cdn.vox-cdn.com/uploads/chorus_asset/file/22682182/D8LI9_the_senate_infrastructure_deal_leaves_out_br_a_lot_of_climate_friendly_policies.png)

The Senate Infrastructure Deal Leaves Much Of Biden S Climate Plan For Reconciliation Later Vox

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Sbam Small Business Association Of Michigan

Ghj Income Tax Reporting For The Employee Retention Credit

Infrastructure Investment And Jobs Act Tax Highlights Sobelco

President Signs Infrastructure Bill With Workplace Provisions

Biden Details 2 Trillion Plan To Rebuild Infrastructure And Reshape The Economy The New York Times

Infrastructure Investment Jobs Act Iannuzzi Manetta

The Infrastructure Bill Makes Crypto Tax Reporting Failures A Felony

The States Getting The Most Money From The Infrastructure Bill

What Is In The Bipartisan Infrastructure Legislation Npr

Infrastructure Bill Tax Provisions Include Erc Termination Journal Of Accountancy News

Infrastructure Investment And Jobs Act Tax Related Provisions